CMG Company Overview: Cmg Stock

Chipotle Mexican Grill (CMG) is a fast-casual restaurant chain specializing in burritos, bowls, salads, and tacos. The company has become a household name for its commitment to fresh, high-quality ingredients and customizable menu options.

History of Chipotle Mexican Grill, Cmg stock

Chipotle Mexican Grill was founded in 1993 by Steve Ells, who opened the first restaurant in Denver, Colorado. The company’s name, which means “spicy” in Spanish, reflects its focus on flavorful and customizable food.

Business Model

Chipotle’s business model centers around offering a limited menu of high-quality, fresh ingredients, prepared in front of customers. The company emphasizes transparency and sustainability in its sourcing practices, using ingredients that are raised with humane treatment and without antibiotics or hormones. This approach has resonated with consumers who are increasingly concerned about food quality and ethical sourcing.

Target Market

Chipotle’s target market is primarily young adults and families seeking a fast, convenient, and affordable meal. The company’s emphasis on customization and fresh ingredients appeals to health-conscious consumers, while its casual atmosphere and reasonable prices make it a popular choice for families and groups.

Financial Performance

Chipotle has consistently demonstrated strong financial performance. The company’s revenue has grown steadily over the past decade, reaching $8.5 billion in 2022. Chipotle has also been profitable for several years, with net income reaching $1.2 billion in 2022. The company’s growth has been fueled by a combination of new restaurant openings and increased same-store sales.

Competitive Landscape

Chipotle faces competition from a wide range of fast-casual and fast-food restaurants, including:

- Qdoba Mexican Eats: Qdoba offers a similar menu to Chipotle, with a focus on customizable burritos, bowls, and salads. The company has a strong presence in the United States and is known for its value pricing.

- Moe’s Southwest Grill: Moe’s Southwest Grill is another fast-casual chain specializing in customizable burritos, bowls, and tacos. The company is known for its friendly service and its use of fresh ingredients.

- Taco Bell: Taco Bell is a fast-food chain that offers a wide variety of Mexican-inspired dishes, including tacos, burritos, and quesadillas. The company is known for its value pricing and its innovative menu offerings.

Chipotle’s competitive advantage lies in its focus on fresh, high-quality ingredients, its commitment to ethical sourcing, and its customizable menu options. The company’s strong brand recognition and loyal customer base have also helped it to maintain a competitive edge.

CMG Stock Analysis

Chipotle Mexican Grill (CMG) is a leading fast-casual restaurant chain known for its fresh, customizable menu. The company has experienced significant growth in recent years, but its stock price has been volatile, reflecting the challenges and opportunities facing the restaurant industry. This analysis explores the current stock price of CMG, examines key factors influencing its performance, and identifies potential risks and opportunities.

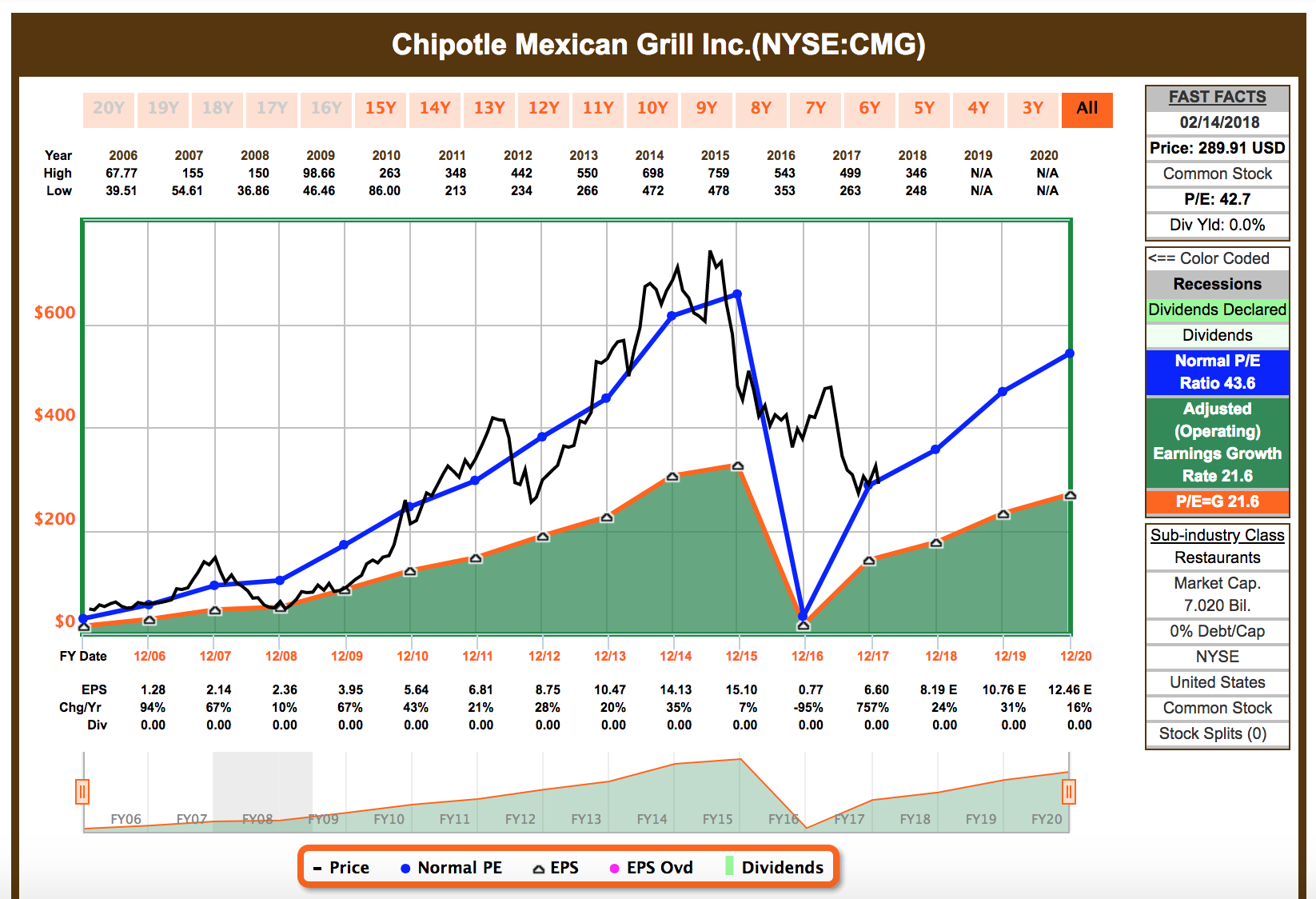

Current Stock Price and Recent Performance

CMG’s stock price has been on a rollercoaster ride in recent years, influenced by factors such as earnings reports, industry trends, and economic conditions. As of [Date], CMG’s stock price is [Price]. This represents a [Percentage] change from its all-time high of [Price] reached on [Date]. The stock’s recent performance has been influenced by factors such as [Specific events impacting stock price].

Key Factors Influencing CMG’s Stock Price

Several key factors influence CMG’s stock price, including:

- Earnings Reports: CMG’s stock price is closely tied to its earnings performance. Investors closely monitor quarterly earnings reports to assess the company’s revenue growth, profitability, and future outlook. Strong earnings reports typically lead to positive stock price movements, while weak earnings can trigger declines.

- Industry Trends: The fast-casual restaurant industry is dynamic and competitive. Trends such as consumer preferences for healthier and more customizable options, the rise of delivery services, and the impact of inflation can all affect CMG’s stock price. For example, CMG’s focus on fresh ingredients and customization aligns well with consumer trends, while its ability to adapt to delivery services can impact its profitability.

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and consumer spending can influence CMG’s stock price. In periods of economic uncertainty, consumers may reduce spending on discretionary items like dining out, potentially impacting CMG’s sales and profitability.

Potential Risks and Opportunities

CMG’s stock price faces both risks and opportunities, both in the short term and long term:

- Short-Term Risks:

- Competition: The fast-casual restaurant industry is highly competitive, with numerous players vying for market share. New entrants and established competitors can put pressure on CMG’s pricing, sales, and profitability.

- Supply Chain Disruptions: CMG relies on a complex supply chain for its ingredients. Disruptions to this supply chain, such as labor shortages or weather-related events, can impact its operations and profitability.

- Inflation: Rising food and labor costs can put pressure on CMG’s margins. The company’s ability to manage these costs effectively is crucial for maintaining profitability.

- Long-Term Opportunities:

- Expanding Market Share: CMG has significant potential to expand its market share, both domestically and internationally. The company continues to open new restaurants and explore new markets, which could drive future growth.

- Innovation: CMG has a history of innovation, introducing new menu items and services to meet evolving consumer preferences. Continued innovation can help the company stay ahead of the competition and attract new customers.

- Digital Transformation: CMG is investing heavily in digital technologies to enhance the customer experience and drive sales. These investments, such as online ordering and delivery services, can help the company reach a wider audience and improve operational efficiency.

Comparison with Competitors

CMG’s stock performance can be compared to its competitors, such as [List of competitors]. These companies operate in similar industries and face similar challenges and opportunities. Comparing CMG’s valuation, growth potential, and profitability to its competitors can provide insights into its relative strengths and weaknesses. For example, [Specific comparison points].

Investing in CMG

Investing in Chipotle Mexican Grill (CMG) offers a chance to participate in the growth of a popular fast-casual restaurant chain. Before diving into potential investment strategies, it’s essential to understand the company’s fundamentals, including its financial performance, competitive landscape, and future prospects.

Investment Strategies for CMG

Different investment strategies can be employed to invest in CMG, each with its own advantages and disadvantages. Here’s a comparison of three popular strategies:

| Strategy | Description | Benefits | Drawbacks |

|---|---|---|---|

| Buy-and-Hold | Purchasing CMG stock and holding it for the long term, regardless of short-term market fluctuations. |

|

|

| Growth Investing | Focusing on companies with high growth potential, like CMG, with the expectation of significant capital appreciation. |

|

|

| Value Investing | Identifying undervalued companies, like CMG, with strong fundamentals but currently trading below their intrinsic value. |

|

|

Hypothetical Investment Portfolio for CMG

A hypothetical investment portfolio for CMG could be designed based on an individual’s risk tolerance and investment goals. For example, a young investor with a high risk tolerance and a long-term investment horizon might allocate a larger portion of their portfolio to CMG, seeking significant capital appreciation. On the other hand, a risk-averse investor with a shorter time horizon might choose a smaller allocation, aiming for steady returns with lower risk.

Diversification and CMG

Diversification is crucial for managing risk in any investment portfolio. Holding a concentrated position in CMG, while potentially offering high returns, also exposes the portfolio to significant risk. If CMG’s stock price declines, the impact on the portfolio can be substantial.

Diversification involves allocating investments across different asset classes, sectors, and geographies to reduce overall risk.

By diversifying across different companies and asset classes, investors can mitigate the impact of any single investment’s underperformance. For example, an investor holding CMG could also invest in other restaurant companies, technology stocks, or real estate to balance their portfolio.

CMG stock, representing Chipotle Mexican Grill, has seen its fair share of ups and downs, mirroring the ever-changing landscape of the fast-casual dining industry. One key figure to keep an eye on is Brian Niccol, CEO of Chipotle, whose own success story, as seen in his impressive brian niccol net worth , might offer some insights into the company’s future trajectory.

Investors closely watch the company’s performance, as it continues to innovate and adapt to consumer preferences, seeking to solidify its position as a leader in the fast-casual market.

CMG stock, representing Chipotle Mexican Grill, has become a popular choice for investors looking for exposure to the fast-casual dining sector. The company’s focus on fresh ingredients and customizable menu options has resonated with consumers, driving impressive growth in recent years.

To gain a deeper understanding of Chipotle’s growth trajectory and the factors influencing CMG stock, check out this insightful analysis: cmg stock. As Chipotle continues to expand its footprint and innovate its offerings, CMG stock remains a compelling investment opportunity for those interested in the restaurant industry.